The 9.9 Percent Is the New American Aristocracy

The class divide is already toxic, and is fast becoming unbridgeable. You’re probably part of the problem.

1. The Aristocracy Is Dead …

For about a week every year in my childhood, I was a member of one of America’s fading aristocracies. Sometimes around Christmas, more often on the Fourth of July, my family would take up residence at one of my grandparents’ country clubs in Chicago, Palm Beach, or Asheville, North Carolina. The breakfast buffets were magnificent, and Grandfather was a jovial host, always ready with a familiar story, rarely missing an opportunity for gentle instruction on proper club etiquette. At the age of 11 or 12, I gathered from him, between his puffs of cigar smoke, that we owed our weeks of plenty to Great-Grandfather, Colonel Robert W. Stewart, a Rough Rider with Teddy Roosevelt who made his fortune as the chairman of Standard Oil of Indiana in the 1920s. I was also given to understand that, for reasons traceable to some ancient and incomprehensible dispute, the Rockefellers were the mortal enemies of our clan. Only much later in life did I learn that the stories about the Colonel and his tangles with titans fell far short of the truth.

At the end of each week, we would return to our place. My reality was the aggressively middle-class world of 1960s and ’70s U.S. military bases and the communities around them. Life was good there, too, but the pizza came from a box, and it was Lucky Charms for breakfast. Our glory peaked on the day my parents came home with a new Volkswagen camper bus. As I got older, the holiday pomp of patriotic luncheons and bridge-playing rituals came to seem faintly ridiculous and even offensive, like an endless birthday party for people whose chief accomplishment in life was just showing up. I belonged to a new generation that believed in getting ahead through merit, and we defined merit in a straightforward way: test scores, grades, competitive résumé-stuffing, supremacy in board games and pickup basketball, and, of course, working for our keep. For me that meant taking on chores for the neighbors, punching the clock at a local fast-food restaurant, and collecting scholarships to get through college and graduate school. I came into many advantages by birth, but money was not among them.

I’ve joined a new aristocracy now, even if we still call ourselves meritocratic winners. If you are a typical reader of The Atlantic, you may well be a member too. (And if you’re not a member, my hope is that you will find the story of this new class even more interesting—if also more alarming.) To be sure, there is a lot to admire about my new group, which I’ll call—for reasons you’ll soon see—the 9.9 percent. We’ve dropped the old dress codes, put our faith in facts, and are (somewhat) more varied in skin tone and ethnicity. People like me, who have waning memories of life in an earlier ruling caste, are the exception, not the rule.

By any sociological or financial measure, it’s good to be us. It’s even better to be our kids. In our health, family life, friendship networks, and level of education, not to mention money, we are crushing the competition below. But we do have a blind spot, and it is located right in the centre of the mirror: We seem to be the last to notice just how rapidly we’ve morphed, or what we’ve morphed into.

The meritocratic class has mastered the old trick of consolidating wealth and passing privilege along at the expense of other people’s children. We are not innocent bystanders to the growing concentration of wealth in our time. We are the principal accomplices in a process that is slowly strangling the economy, destabilizing American politics, and eroding democracy. Our delusions of merit now prevent us from recognizing the nature of the problem that our emergence as a class represents. We tend to think that the victims of our success are just the people excluded from the club. But history shows quite clearly that, in the kind of game we’re playing, everybody loses badly in the end.

2. The Discreet Charm of the 9.9 Percent

Let’s talk first about money—even if money is only one part of what makes the new aristocrats special. There is a familiar story about rising inequality in the United States, and its stock characters are well known. The villains are the fossil-fueled plutocrat, the Wall Street fat cat, the callow tech bro, and the rest of the so-called top 1 percent. The good guys are the 99 percent, otherwise known as “the people” or “the middle class.” The arc of the narrative is simple: Once we were equal, but now we are divided. The story has a grain of truth to it. But it gets the characters and the plot wrong in basic ways.

It is in fact the top 0.1 percent who have been the big winners in the growing concentration of wealth over the past half century. According to the UC Berkeley economists Emmanuel Saez and Gabriel Zucman, the 160,000 or so households in that group held 22 percent of America’s wealth in 2012, up from 10 percent in 1963. If you’re looking for the kind of money that can buy elections, you’ll find it inside the top 0.1 percent alone.

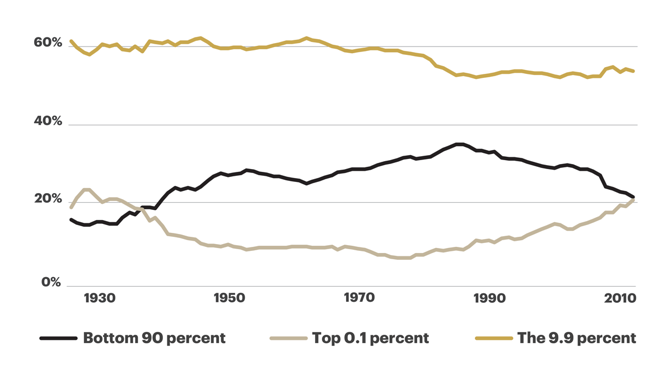

A Tale of Three Classes (Figure 1):

The 9.9 percent hold most of the wealth in the United States.

Every piece of the pie picked up by the 0.1 percent, in relative terms, had to come from the people below. But not everyone in the 99.9 percent gave up a slice. Only those in the bottom 90 percent did. At their peak, in the mid-1980s, people in this group held 35 percent of the nation’s wealth. Three decades later that had fallen 12 points—exactly as much as the wealth of the 0.1 percent rose.

In between the top 0.1 percent and the bottom 90 percent is a group that has been doing just fine. It has held on to its share of a growing pie decade after decade. And as a group, it owns substantially more wealth than do the other two combined. In the tale of three classes (see Figure 1), it is represented by the gold line floating high and steady while the other two duke it out. You’ll find the new aristocracy there. We are the 9.9 percent.

So what kind of characters are we, the 9.9 percent? We are mostly not like those flamboyant political manipulators from the 0.1 percent. We’re a well-behaved, flannel-suited crowd of lawyers, doctors, dentists, mid-level investment bankers, M.B.A.s with opaque job titles, and assorted other professionals—the kind of people you might invite to dinner. In fact, we’re so self-effacing, we deny our own existence. We keep insisting that we’re “middle class.”

As of 2016, it took $1.2 million in net worth to make it into the 9.9 percent; $2.4 million to reach the group’s median; and $10 million to get into the top 0.9 percent. (And if you’re not there yet, relax: Our club is open to people who are on the right track and have the right attitude.) “We are the 99 percent” sounds righteous, but it’s a slogan, not an analysis. The families at our end of the spectrum wouldn’t know what to do with a pitchfork.

We are also mostly, but not entirely, white. According to a Pew Research Center analysis, African Americans represent 1.9 percent of the top 10th of households in wealth; Hispanics, 2.4 percent; and all other minorities, including Asian and multiracial individuals, 8.8 percent—even though those groups together account for 35 percent of the total population.

One of the hazards of life in the 9.9 percent is that our necks get stuck in the upward position. We gaze upon the 0.1 percent with a mixture of awe, envy, and eagerness to obey. As a consequence, we are missing the other big story of our time. We have left the 90 percent in the dust—and we’ve been quietly tossing down roadblocks behind us to make sure that they never catch up.

Let’s suppose that you start off right in the middle of the American wealth distribution. How high would you have to jump to make it into the 9.9 percent? In financial terms, the measurement is easy and the trend is unmistakable. In 1963, you would have needed to multiply your wealth six times. By 2016, you would have needed to leap twice as high—increasing your wealth 12-fold—to scrape into our group. If you boldly aspired to reach the middle of our group rather than its lower edge, you’d have needed to multiply your wealth by a factor of 25. On this measure, the 2010s look much like the 1920s.

If you are starting at the median for people of colour, you’ll want to practice your financial pole-vaulting. The Institute for Policy Studies calculated that, setting aside money invested in “durable goods” such as furniture and a family car, the median black family had net wealth of $1,700 in 2013, and the median Latino family had $2,000, compared with $116,800 for the median white family. A 2015 study in Boston found that the wealth of the median white family there was $247,500, while the wealth of the median African American family was $8. That is not a typo. That’s two grande cappuccinos. That and another 300,000 cups of coffee will get you into the 9.9 percent.

None of this matters, you will often hear, because in the United States everyone has an opportunity to make the leap: Mobility justifies inequality. As a matter of principle, this isn’t true. In the United States, it also turns out not to be true as a factual matter. Contrary to popular myth, economic mobility in the land of opportunity is not high, and it’s going down.

Imagine yourself on the socioeconomic ladder with one end of a rubber band around your ankle and the other around your parents’ rung. The strength of the rubber determines how hard it is for you to escape the rung on which you were born. If your parents are high on the ladder, the band will pull you up should you fall; if they are low, it will drag you down when you start to rise. Economists represent this concept with a number they call “intergenerational earnings elasticity,” or IGE, which measures how much of a child’s deviation from average income can be accounted for by the parents’ income. An IGE of zero means that there’s no relationship at all between parents’ income and that of their offspring. An IGE of one says that the destiny of a child is to end up right where she came into the world.

According to Miles Corak, an economics professor at the City University of New York, half a century ago IGE in America was less than 0.3. Today, it is about 0.5. In America, the game is half over once you’ve selected your parents. IGE is now higher here than in almost every other developed economy. On this measure of economic mobility, the United States is more like Chile or Argentina than Japan or Germany.

The story becomes even more disconcerting when you see just where on the ladder the tightest rubber bands are located. Canada, for example, has an IGE of about half that of the U.S. Yet from the middle rungs of the two countries’ income ladders, offspring move up or down through the nearby deciles at the same respectable pace. The difference is in what happens at the extremes. In the United States, it’s the children of the bottom decile and, above all, the top decile—the 9.9 percent—who settle down nearest to their starting point. Here in the land of opportunity, the taller the tree, the closer the apple falls.

All of this analysis of wealth percentiles, to be clear, provides only a rough start in understanding America’s evolving class system. People move in and out of wealth categories all the time without necessarily changing social class, and they may belong to a different class in their own eyes than they do in others’. Yet even if the trends in the monetary statistics are imperfect illustrations of a deeper process, they are nonetheless registering something of the extraordinary transformation that’s taking place in our society.

A few years ago, Alan Krueger, an economist and a former chairman of the Obama administration’s Council of Economic Advisers, was reviewing the international mobility data when he caught a glimpse of the fundamental process underlying our present moment. Rising immobility and rising inequality aren’t like two pieces of driftwood that happen to have shown up on the beach at the same time, he noted. They wash up together on every shore. Across countries, the higher the inequality, the higher the IGE (see Figure 2). It’s as if human societies have a natural tendency to separate, and then, once the classes are far enough apart, to crystallize.

The Great Gatsby Curve (Figure 2): Inequality and class immobility go together.

Economists are prudent creatures, and they’ll look up from a graph like that and remind you that it shows only correlation, not causation. That’s a convenient hedge for those of us at the top because it keeps alive one of the founding myths of America’s meritocracy: that our success has nothing to do with other people’sfailure. It’s a pleasant idea. But around the world and throughout history, the wealthy have advanced the crystallization process in a straightforward way. They have taken their money out of productive activities and put it into walls. Throughout history, moreover, one social group above all others has assumed responsibility for maintaining and defending these walls. Its members used to be called aristocrats. Now we’re the 9.9 percent. The main difference is that we have figured out how to use the pretence of being part of the middle as one of our strategies for remaining on top.

Krueger liked the graph shown in Figure 2 so much that he decided to give it a name: the Great Gatsby Curve. It’s a good choice, and it resonates strongly with me. F. Scott Fitzgerald’s novel about the breakdown of the American dream is set in 1922, or right around the time that my great-grandfather was secretly siphoning money from Standard Oil and putting it into a shell company in Canada. It was published in 1925, just as special counsel was turning up evidence that bonds from that company had found their way into the hands of the secretary of the interior. Its author was drinking his way through the cafés of Paris just as Colonel Robert W. Stewart was running away from subpoenas to testify before the United States Senate about his role in the Teapot Dome scandal. We are only now closing in on the peak of inequality that his generation achieved, in 1928. I’m sure they thought it would go on forever, too.

3. The Origin of a Species

Money can’t buy you class, or so my grandmother used to say. But it can buy a private detective. Grandmother was a Kentucky debutante and sometime fashion model (kind of like Daisy Buchanan in The Great Gatsby, weirdly enough), so she knew what to do when her eldest son announced his intention to marry a woman from Spain. A gumshoe promptly reported back that the prospective bride’s family made a living selling newspapers on the streets of Barcelona. Grandmother instituted an immediate and total communications embargo. In fact, my mother’s family owned and operated a large paper-goods factory. When children came, Grandmother at last relented. Determined to do the right thing, she arranged for the new family, then on military assignment in Hawaii, to be inscribed in the New York Social Register.

Sociologists would say, in their dry language, that my grandmother was a zealous manager of the family’s social capital—and she wasn’t about to let some Spanish street urchin run away with it. She did have a point, even if her facts were wrong. Money may be the measure of wealth, but it is far from the only form of it. Family, friends, social networks, personal health, culture, education, and even location are all ways of being rich, too. These nonfinancial forms of wealth, as it turns out, aren’t simply perks of membership in our aristocracy. They define us.

We are the people of good family, good health, good schools, good neighbourhoods, and good jobs. We may want to call ourselves the “5Gs” rather than the 9.9 percent. We are so far from the not-so-good people on all of these dimensions, we are beginning to resemble a new species. And, just as in Grandmother’s day, the process of speciation begins with a love story—or, if you prefer, sexual selection.

The polite term for the process is assortative mating. The phrase is sometimes used to suggest that this is another of the wonders of the internet age, where popcorn at last meets butter and Yankees fan finds Yankees fan. In fact, the frenzy of assortative mating today results from a truth that would have been generally acknowledged by the heroines of any Jane Austen novel: Rising inequality decreases the number of suitably wealthy mates even as it increases the reward for finding one and the penalty for failing to do so. According to one study, the last time marriage partners sorted themselves by educational status as much as they do now was in the 1920s.

For most of us, the process is happily invisible. You meet someone under a tree on an exclusive campus or during orientation at a high-powered professional firm, and before you know it, you’re twice as rich. But sometimes—Grandmother understood this well—extra measures are called for. That’s where our new technology puts bumbling society detectives to shame. Ivy Leaguers looking to mate with their equals can apply to join a dating service called the League. It’s selective, naturally: Only 20 to 30 percent of New York applicants get in. It’s sometimes called “Tinder for the elites.”

It is misleading to think that assortative mating is symmetrical, as in city mouse marries city mouse and country mouse marries country mouse. A better summary of the data would be: Rich mouse finds love, and poor mouse gets screwed. It turns out—who knew?—that people who are struggling to keep it all together have a harder time hanging on to their partner. According to the Harvard political scientist Robert Putnam, 60 years ago just 20 percent of children born to parents with a high-school education or less lived in a single-parent household; now that figure is nearly 70 percent. Among college-educated households, by contrast, the single-parent rate remains less than 10 percent. Since the 1970s, the divorce rate has declined significantly among college-educated couples, while it has risen dramatically among couples with only a high-school education—even as marriage itself has become less common. The rate of single parenting is in turn the single most significant predictor of social immobility across counties, according to a study led by the Stanford economist Raj Chetty.

None of which is to suggest that individuals are wrong to seek a suitable partner and make a beautiful family. People should—and presumably always will—pursue happiness in this way. It’s one of the delusions of our meritocratic class, however, to assume that if our actions are individually blameless, then the sum of our actions will be good for society. We may have studied Shakespeare on the way to law school, but we have little sense for the tragic possibilities of life. The fact of the matter is that we have silently and collectively opted for inequality, and this is what inequality does. It turns marriage into a luxury good, and a stable family life into a privilege that the moneyed elite can pass along to their children. How do we think that’s going to work out?

This divergence of families by class is just one part of a process that is creating two distinct forms of life in our society. Stop in at your local yoga studio or SoulCycle class, and you’ll notice that the same process is now inscribing itself in our own bodies. In 19th-century England, the rich really were different. They didn’t just have more money; they were taller—a lot taller. According to a study colorfully titled “On English Pygmies and Giants,” 16-year-old boys from the upper classes towered a remarkable 8.6 inches, on average, over their undernourished, lower-class countrymen. We are reproducing the same kind of division via a different set of dimensions.

Obesity, diabetes, heart disease, kidney disease, and liver disease are all two to three times more common in individuals who have a family income of less than $35,000 than in those who have a family income greater than $100,000. Among low-educated, middle-aged whites, the death rate in the United States—alone in the developed world—increased in the first decade and a half of the 21st century. Driving the trend is the rapid growth in what the Princeton economists Anne Case and Angus Deaton call “deaths of despair”—suicides and alcohol- and drug-related deaths.

The sociological data are not remotely ambiguous on any aspect of this growing divide. We 9.9 percenters live in safer neighbourhoods, go to better schools, have shorter commutes, receive higher-quality health care, and, when circumstances require, serve time in better prisons. We also have more friends—the kind of friends who will introduce us to new clients or line up great internships for our kids.

These special forms of wealth offer the further advantages that they are both harder to emulate and safer to brag about than high income alone. Our class walks around in the jeans and T‑shirts inherited from our supposedly humble beginnings. We prefer to signal our status by talking about our organically nourished bodies, the awe-inspiring feats of our offspring, and the ecological correctness of our neighbourhoods. We have figured out how to launder our money through higher virtues.

Most important of all, we have learned how to pass all of these advantages down to our children. In America today, the single best predictor of whether an individual will get married, stay married, pursue advanced education, live in a good neighbourhood, have an extensive social network, and experience good health is the performance of his or her parents on those same metrics.

We’re leaving the 90 percent and their offspring far behind in a cloud of debts and bad life choices that they somehow can’t stop themselves from making. We tend to overlook the fact that parenting is more expensive and motherhood more hazardous in the United States than in any other developed country, that campaigns against family planning and reproductive rights are an assault on the families of the bottom 90 percent, and that law-and-order politics serves to keep even more of them down. We prefer to interpret their relative poverty as vice: Why can’t they get their act together?

New forms of life necessarily give rise to new and distinct forms of consciousness. If you doubt this, you clearly haven’t been reading the “personal and household services” ads on Monster.com. At the time of this writing, the section for my town of Brookline, Massachusetts, featured one placed by a “busy professional couple” seeking a “Part Time Nanny.” The nanny (or manny—the ad scrupulously avoids committing to gender) is to be “bright, loving, and energetic”; “friendly, intelligent, and professional”; and “a very good communicator, both written and verbal.” She (on balance of probability) will “assist with the care and development” of two children and will be “responsible for all aspects of the children’s needs,” including bathing, dressing, feeding, and taking the young things to and from school and activities. That’s why a “college degree in early childhood education” is “a plus.”

In short, Nanny is to have every attribute one would want in a terrific, professional, college-educated parent. Except, of course, the part about being an actual professional, college-educated parent. There is no chance that Nanny will trade places with our busy 5G couple. She “must know the proper etiquette in a professionally run household” and be prepared to “accommodate changing circumstances.” She is required to have “5+ years experience as a Nanny,” which makes it unlikely that she’ll have had time to get the law degree that would put her on the other side of the bargain. All of Nanny’s skills, education, experience, and professionalism will land her a job that is “Part Time.”

The ad is written in flawless, 21st-century business-speak, but what it is really seeking is a governess—that exquisitely contradictory figure in Victorian literature who is both indistinguishable in all outward respects from the upper class and yet emphatically not a member of it. Nanny’s best bet for moving up in the world is probably to follow the example of Jane Eyre and run off with the lord (or lady) of the manor.

If you look beyond the characters in this unwritten novel about Nanny and her 5G masters, you’ll see a familiar shape looming on the horizon. The Gatsby Curve has managed to reproduce itself in social, physiological, and cultural capital. Put more accurately: There is only one curve, but it operates through a multiplicity of forms of wealth.

Rising inequality does not follow from a hidden law of economics, as the otherwise insightful Thomas Piketty suggested when he claimed that the historical rate of return on capital exceeds the historical rate of growth in the economy. Inequality necessarily entrenches itself through other, nonfinancial, intrinsically invidious forms of wealth and power. We use these other forms of capital to project our advantages into life itself. We look down from our higher virtues in the same way the English upper class looked down from its taller bodies, as if the distinction between superior and inferior were an artifact of nature. That’s what aristocrats do.

4. The Privilege of an Education

My 16-year-old daughter is sitting on a couch, talking with a stranger about her dreams for the future. We’re here, ominously enough, because, she says, “all my friends are doing it.” For a moment, I wonder whether we have unintentionally signed up for some kind of therapy. The professional woman in the smart-casual suit throws me a pointed glance and says, “It’s normal to be anxious at a time like this.” She really does see herself as a therapist of sorts. But she does not yet seem to know that the source of my anxiety is the idea of shelling out for a $12,000 “base package” of college-counseling services whose chief purpose is apparently to reduce my anxiety. Determined to get something out of this trial counseling session, I push for recommendations on summer activities. We leave with a tip on a 10-day “cultural tour” of France for high schoolers. In the college-application business, that’s what’s known as an “enrichment experience.” When we get home, I look it up. The price of enrichment: $11,000 for the 10 days.

That’s when I hear the legend of the SAT whisperer. If you happen to ride through the yellow-brown valleys of the California coast, past the designer homes that sprout wherever tech unicorns sprinkle their golden stock offerings, you might come across him. His high-school classmates still remember him, almost four decades later, as one of the child wonders of the age. Back then, he and his equally precocious siblings showed off their preternatural verbal and musical talents on a local television program. Now his clients fly him around the state for test-prep sessions with their 16-year-olds. You can hire him for $750, plus transportation, per two-hour weekend session. (There is a weekday discount.) Some of his clients book him every week for a year.

At this point, I’m wondering whether life was easier in the old days, when you could buy a spot in the elite university of your choice with cold cash. Then I remind myself that Grandfather lasted only one year at Yale. In those days, the Ivies kicked you out if you weren’t ready for action. Today, you have to self-combust in a newsworthy way before they show you the door.

Inevitably, I begin rehearsing the speech for my daughter. It’s perfectly possible to lead a meaningful life without passing through a name-brand college, I’m going to say. We love you for who you are. We’re not like those tacky strivers who want a back-windshield sticker to testify to our superior parenting skills. And why would you want to be an investment banker or a corporate lawyer anyway? But I refrain from giving the speech, knowing full well that it will light up her parental-bullshit detector like a pair of khakis on fire.

The skin colours of the nation’s elite student bodies are more varied now, as are their genders, but their financial bones have calcified over the past 30 years. In 1985, 54 percent of students at the 250 most selective colleges came from families in the bottom three quartiles of the income distribution. A similar review of the class of 2010 put that figure at just 33 percent. According to a 2017 study, 38 elite colleges—among them five of the Ivies—had more students from the top 1 percent than from the bottom 60 percent. In his 2014 book, Excellent Sheep, William Deresiewicz, a former English professor at Yale, summed up the situation nicely: “Our new multiracial, gender-neutral meritocracy has figured out a way to make itself hereditary.”

The wealthy can also draw on a variety of affirmative-action programs designed just for them. As Daniel Golden points out in The Price of Admission, legacy-admissions policies reward those applicants with the foresight to choose parents who attended the university in question. Athletic recruiting, on balance and contrary to the popular wisdom, also favors the wealthy, whose children pursue lacrosse, squash, fencing, and the other cost-intensive sports at which private schools and elite public schools excel. And, at least among members of the 0.1 percent, the old-school method of simply handing over some of Daddy’s cash has been making a comeback.

The mother lode of all affirmative-action programs for the wealthy, of course, remains the private school. Only 2.2 percent of the nation’s students graduate from nonsectarian private high schools, and yet these graduates account for 26 percent of students at Harvard and 28 percent of students at Princeton. The other affirmative-action programs, the kind aimed at diversifying the look of the student body, are no doubt well intended. But they are to some degree merely an extension of this system of wealth preservation. Their function, at least in part, is to indulge rich people in the belief that their college is open to all on the basis of merit.

The plummeting admission rates of the very top schools nonetheless leave many of the children of the 9.9 percent facing long odds. But not to worry, junior 9.9 percenters! We’ve

created a new range of elite colleges just for you. Thanks to ambitious university administrators and the ever-expanding rankings machine at U.S. News & World Report, 50 colleges are now as selective as Princeton was in 1980, when I applied. The colleges seem to think that piling up rejections makes them special. In fact, it just means that they have collectively opted to deploy their massive, tax-subsidized endowments to replicate privilege rather than fulfill their duty to produce an educated public.

The only thing going up as fast as the rejection rates at selective colleges is the astounding price of tuition. Measured relative to the national median salary, tuition and fees at top colleges more than tripled from 1963 to 2013. Throw in the counselors, the whisperers, the violin lessons, the private schools, and the cost of arranging for Junior to save a village in Micronesia, and it adds up. To be fair, financial aid closes the gap for many families and keeps the average cost of college from growing as fast as the sticker price. But that still leaves a question: Why are the wealthy so keen to buy their way in?

The short answer, of course, is that it’s worth it.

In the United States, the premium that college graduates earn over their non-college-educated peers in young adulthood exceeds 70 percent. The return on education is 50 percent higher than what it was in 1950, and is significantly higher than the rate in every other developed country. In Norway and Denmark, the college premium is less than 20 percent; in Japan, it is less than 30 percent; in France and Germany, it’s about 40 percent.

All of this comes before considering the all-consuming difference between “good” schools and the rest. Ten years after starting college, according to data from the Department of Education, the top decile of earners from all schools had a median salary of $68,000. But the top decile from the 10 highest-earning colleges raked in $220,000—make that $250,000 for No. 1, Harvard—and the top decile at the next 30 colleges took home $157,000. (Not surprisingly, the top 10 had an average acceptance rate of 9 percent, and the next 30 were at 19 percent.)

It is entirely possible to get a good education at the many schools that don’t count as “good” in our brand-obsessed system. But the “bad” ones really are bad for you. For those who made the mistake of being born to the wrong parents, our society offers a kind of virtual education system. It has places that look like colleges—but aren’t really. It has debt—and that, unfortunately, is real. The people who enter into this class hologram do not collect a college premium; they wind up in something more like indentured servitude.

So what is the real source of this premium for a “good education” that we all seem to crave?

One of the stories we tell ourselves is that the premium is the reward for the knowledge and skills the education provides us. Another, usually unfurled after a round of drinks, is that the premium is a reward for the superior cranial endowments we possessed before setting foot on campus. We are, as some sociologists have delicately put it, a “cognitive elite.”

Behind both of these stories lies one of the founding myths of our meritocracy. One way or the other, we tell ourselves, the rising education premium is a direct function of the rising value of meritorious people in a modern economy. That is, not only do the meritorious get ahead, but the rewards we receive are in direct proportion to our merit.

But the fact is that degree holders earn so much more than the rest not primarily because they are better at their job, but because they mostly take different categories of jobs. Well over half of Ivy League graduates, for instance, typically go straight into one of four career tracks that are generally reserved for the well educated: finance, management consulting, medicine, or law. To keep it simple, let’s just say that there are two types of occupations in the world: those whose members have collective influence in setting their own pay, and those whose members must face the music on their own. It’s better to be a member of the first group. Not surprisingly, that is where you will find the college crowd.

Why do america’s doctors make twice as much as those of other wealthy countries? Given that the United States has placed dead last five times running in the Commonwealth Fund’s ranking of health-care systems in high-income countries, it’s hard to argue that they are twice as gifted at saving lives. Dean Baker, a senior economist with the Centre for Economic and Policy Research, has a more plausible suggestion: “When economists like me look at medicine in America—whether we lean left or right politically—we see something that looks an awful lot like a cartel.” Through their influence on the number of slots at medical schools, the availability of residencies, the licensing of foreign-trained doctors, and the role of nurse practitioners, physicians’ organizations can effectively limit the competition their own members face—and that is exactly what they do.

Lawyers (or at least a certain elite subset of them) have apparently learned to play the same game. Even after the collapse of the so-called law-school bubble, America’s lawyers are No. 1 in international salary rankings and earn more than twice as much, on average, as their wig-toting British colleagues. The University of Chicago law professor Todd Henderson, writing for Forbes in 2016, offered a blunt assessment: “The American Bar Association operates a state-approved cartel.”

Similar occupational licensing schemes provide shelter for the meritorious in a variety of other sectors. The policy researchers Brink Lindsey and Steven Teles detail the mechanisms in The Captured Economy. Dentists’ offices, for example, have a glass ceiling that limits what dental hygienists can do without supervision, keeping their bosses in the 9.9 percent. Copyright and patent laws prop up profits and salaries in the education-heavy pharmaceutical, software, and entertainment sectors. These arrangements are trifles, however, compared with what’s on offer in tech and finance, two of the most powerful sectors of the economy.

By now we’re thankfully done with the tech-sector fairy tales in which whip-smart cowboys innovate the heck out of a stodgy status quo. The reality is that five monster companies—you know the names—are worth about $3.5 trillion combined, and represent more than 40 percent of the market capital on the nasdaq stock exchange. Much of the rest of the technology sector consists of virtual entities waiting patiently to feed themselves to these beasts.

Let’s face it: This is Monopoly money with a smiley emoji. Our society figured out some time ago how to deal with companies that attempt to corner the market on viscous substances like oil. We don’t yet know what to do with the monopolies that arise out of networks and scale effects in the information marketplace. Until we do, the excess profits will stick to those who manage to get closest to the information honeypot. You can be sure that these people will have a great deal of merit.

The candy-hurling godfather of today’s meritocratic class, of course, is the financial-services industry. Americans now turn over $1 of every $12 in GDP to the financial sector; in the 1950s, the bankers were content to keep only $1 out of $40. The game is more sophisticated than a two-fisted money grab, but its essence was made obvious during the 2008 financial crisis. The public underwrites the risks; the financial gurus take a seat at the casino; and it’s heads they win, tails we lose. The financial system we now have is not a product of nature. It has been engineered, over decades, by powerful bankers, for their own benefit and for that of their posterity.

Who is not in on the game? Auto workers, for example. Caregivers. Retail workers. Furniture makers. Food workers. The wages of American manufacturing and service workers consistently hover in the middle of international rankings. The exceptionalism of American compensation rates comes to an end in the kinds of work that do not require a college degree.

You see, when educated people with excellent credentials band together to advance their collective interest, it’s all part of serving the public good by ensuring a high quality of service, establishing fair working conditions, and giving merit its due. That’s why we do it through “associations,” and with the assistance of fellow professionals wearing white shoes. When working-class people do it—through unions—it’s a violation of the sacred principles of the free market. It’s thuggish and anti-modern. Imagine if workers hired consultants and “compensation committees,” consisting of their peers at other companies, to recommend how much they should be paid. The result would be—well, we know what it would be, because that’s what CEOs do.

It isn’t a coincidence that the education premium surged during the same years that membership in trade unions collapsed. In 1954, 28 percent of all workers were members of trade unions, but by 2017 that figure was down to 11 percent.

Education—the thing itself, not the degree—is always good. A genuine education opens minds and makes good citizens. It ought to be pursued for the sake of society. In our unbalanced system, however, education has been reduced to a private good, justifiable only by the increments in graduates’ pay checks. Instead of uniting and enriching us, it divides and impoverishes.

Which is really just a way of saying that our worthy ideals of educational opportunity are ultimately no match for the tidal force of the Gatsby Curve. The metric that has tracked the rising college premium with the greatest precision is—that’s right—intergenerational earnings elasticity, or IGE. Across countries, the same correlation obtains: the higher the college premium, the lower the social mobility.

As I’m angling all the angles for my daughter’s college applications—the counsellor is out, and the SAT whisperer was never going to happen—I realize why this delusion of merit is so hard to shake. If I—I mean, she—can pull this off, well, there’s the proof that we deserve it! If the system can be gamed, well then, our ability to game the system has become the new test of merit.

So go ahead and replace the SATs with shuffleboard on the high seas, or whatever you want. Who can doubt that we’d master that game, too? How quickly would we convince ourselves of our absolute entitlement to the riches that flow directly and tangibly from our shuffling talent? How soon before we perfected the art of raising shuffleboard wizards? Would any of us notice or care which way the ship was heading?Let’s suppose that some of us do look up. We see the iceberg. Will that induce us to diminish our exertions in supreme child-rearing? The grim truth is that, as long as good parenting and good citizenship are in conflict, we’re just going to pack a few more violins for the trip.

5. The Invisible Hand of Government

As far as Grandfather was concerned, the assault on the productive classes began long before the New Deal. It all started in 1913, with the ratification of the Sixteenth Amendment. In case you’ve forgotten, that amendment granted the federal government the power to levy a direct personal-income tax. It also happens that ratification took place just a few months after Grandfather was born, which made sense to me in a strange way. By far the largest part of his lifetime income was attributable to his birth.

Grandfather was a stockbroker for a time. I eventually figured out that he mostly traded his own portfolio and bought a seat at the stock exchange for the purpose. Politics was a hobby, too. At one point, he announced his intention to seek the Republican nomination for lieutenant governor of Connecticut. (It wasn’t clear whether anybody outside the clubhouse heard him.) What he really liked to do was fly. The memories that mattered most to him were his years of service as a transport pilot during World War II. Or the time he and Grandmother took to the Midwestern skies in a barnstorming plane. My grandparents never lost faith in the limitless possibilities of a life free from government. But in their last years, as the reserves passed down from the Colonel ran low, they became pretty diligent about collecting their Social Security and Medicare benefits.

There is a page in the book of American political thought—Grandfather knew it by heart—that says we must choose between government and freedom. But if you read it twice, you’ll see that what it really offers is a choice between government you can see and government you can’t. Aristocrats always prefer the invisible kind of government. It leaves them free to exercise their privileges. We in the 9.9 percent have mastered the art of getting the government to work for us even while complaining loudly that it’s working for those other people.

Consider, for starters, the greatly exaggerated reports of our tax burdens. On guest panels this past holiday season, apologists for the latest round of upwardly aimed tax cuts offered versions of Mitt Romney’s claim that the 47 percent of Americans who pay no federal income tax in a typical year have “no skin in the game.” Baloney. Sure, the federal individual-income tax, which raised $1.6 trillion last year, remains progressive. But the $1.2 trillion raised by the payroll tax hits all workers—but not investors, such as Romney—and it hits those making lower incomes at a higher rate, thanks to a cap on the amount of income subject to the tax. Then there’s the $2.3 trillion raised by state and local governments, much of it collected through regressive sales and property taxes. The poorest quintile of Americans pays more than twice the rate of state taxes as the top 1 percent does, and about half again what the top 10 percent pays.

Our false protests about paying all the taxes, however, sound like songs of innocence compared with our mastery of the art of having the taxes returned to us. The income-tax system that so offended my grandfather has had the unintended effect of creating a highly discreet category of government expenditures. They’re called “tax breaks,” but it’s better to think of them as handouts that spare the government the inconvenience of collecting the money in the first place. In theory, tax expenditures can be used to support any number of worthy social purposes, and a few of them, such as the earned income-tax credit, do actually go to those with a lower income. But more commonly, because their value is usually a function of the amount of money individuals have in the first place, and those individuals’ marginal tax rates, the benefits flow uphill.

Let us count our blessings: Every year, the federal government doles out tax expenditures through deductions for retirement savings (worth $137 billion in 2013); employer-sponsored health plans ($250 billion); mortgage-interest payments ($70 billion); and, sweetest of all, income from watching the value of your home, stock portfolio, and private-equity partnerships grow ($161 billion). In total, federal tax expenditures exceeded $900 billion in 2013. That’s more than the cost of Medicare, more than the cost of Medicaid, more than the cost of all other federal safety-net programs put together. And—such is the beauty of the system—51 percent of those handouts went to the top quintile of earners, and 39 percent to the top decile.

The best thing about this program of reverse taxation, as far as the 9.9 percent are concerned, is that the bottom 90 percent haven’t got a clue. The working classes get riled up when they see someone at the grocery store flipping out their food stamps to buy a T-bone. They have no idea that a nice family on the other side of town is walking away with $100,000 for flipping their house.

But wait, there’s more! Let’s not forget about the kids. If the secrets of a nation’s soul may be read from its tax code, then our nation must be in love with the children of rich people. The 2017 tax law raises the amount of money that married couples can pass along to their heirs tax-free from a very generous $11 million to a magnificent $22 million. Correction: It’s not merely tax-free; it’s tax-subsidized. The unrealized tax liability on the appreciation of the house you bought 40 years ago, or on the stock portfolio that has been gathering moths—all of that disappears when you pass the gains along to the kids. Those foregone taxes cost the United States Treasury $43 billion in 2013 alone—about three times the amount spent on the Children’s Health Insurance Program.

Grandfather’s father, the Colonel, died in 1947, when the maximum estate-tax rate was a now-unheard-of 77 percent. When the remainder was divvied up among four siblings, Grandfather had barely enough to pay for the Bentley and keep up with dues at the necessary clubs. The government made sure that I would grow up in the middle class. And for that I will always be grateful.

6. The Gilded Zip Code

From my Brookline home, it’s a pleasant, 10-minute walk to get a haircut. Along the way, you pass immense elm trees and brochure-ready homes beaming in their reclaimed Victorian glory. Apart from a landscaper or two, you are unlikely to spot a human being in this wilderness of oversize closets, wood-paneled living rooms, and Sub-Zero refrigerators. If you do run into a neighbour, you might have a conversation like this: “Our kitchen remodel went way over budget. We had to fight just to get the tile guy to show up!” “I know! We ate Thai takeout for a month because the gas guy’s car kept breaking down!” You arrive at the Supercuts fresh from your stroll, but the nice lady who cuts your hair is looking stressed. You’ll discover that she commutes an hour through jammed highways to work. The gas guy does, too, and the tile guy comes in from another state. None of them can afford to live around here. The rent is too damn high.

From 1980 to 2016, home values in Boston multiplied 7.6 times. When you take account of inflation, they generated a return of 157 percent to their owners. San Francisco returned 162 percent in real terms over the same period; New York, 115 percent; and Los Angeles, 114 percent. If you happen to live in a neighbourhood like mine, you are surrounded by people who consider themselves to be real-estate geniuses. (That’s one reason we can afford to make so many mistakes in the home-renovation department.) If you live in St. Louis (3 percent) or Detroit (minus 16 percent), on the other hand, you weren’t so smart. In 1980, a house in St. Louis would trade for a decent studio apartment in Manhattan. Today that house will buy an 80-square-foot bathroom in the Big Apple.

The returns on (the right kind of) real estate have been so extraordinary that, according to some economists, real estate alone may account for essentially all of the increase in wealth concentration over the past half century. It’s not surprising that the values are up in the major cities: These are the gold mines of our new economy. Yet there is a paradox. The rent is so high that people—notably people in the middle class—are leaving town rather than working the mines. From 2000 to 2009, the San Francisco Bay Area had some of the highest salaries in the nation, and yet it lost 350,000 residents to lower-paying regions. Across the United States, the journalist and economist Ryan Avent writes in The Gated City, “the best opportunities are found in one place, and for some reason most Americans are opting to live in another.” According to estimates from the economists Enrico Moretti and Chang-Tai Hsieh, the migration away from the productive centres of New York, San Francisco, and San Jose alone lopped 9.7 percent off total U.S. growth from 1964 to 2009.

It is well known by now that the immediate cause of the insanity is the unimaginable pettiness of backyard politics. Local zoning regulation imposes excessive restrictions on housing development and drives up prices. What is less well understood is how central the process of depopulating the economic core of the nation is to the intertwined stories of rising inequality and falling social mobility.

This economic and educational sorting of neighbourhoods is often represented as a matter of personal preference, as in red people like to hang with red, and blue with blue. In reality, it’s about the consolidation of wealth in all its forms, starting, of course, with money. Gilded zip codes are located next to giant cash machines: a too-big-to-fail bank, a friendly tech monopoly, and so on. Local governments, which collected a record $523 billion in property taxes in 2016, make sure that much of the money stays close to home.

But proximity to economic power isn’t just a means of hoarding the pennies; it’s a force of natural selection. Gilded zip codes deliver higher life expectancy, more-useful social networks, and lower crime rates. Lengthy commutes, by contrast, cause obesity, neck pain, stress, insomnia, loneliness, and divorce, as Annie Lowrey reported in Slate. One study found that a commute of 45 minutes or longer by one spouse increased the chance of divorce by 40 percent.

Nowhere are the mechanics of the growing geographic divide more evident than in the system of primary and secondary education. Public schools were born amid hopes of opportunity for all; the best of them have now been effectively reprivatized to better serve the upper classes. According to a widely used school-ranking service, out of more than 5,000 public elementary schools in California, the top 11 are located in Palo Alto. They’re free and open to the public. All you have to do is move into a town where the median home value is $3,211,100. Scarsdale, New York, looks like a steal in comparison: The public high schools in that area funnel dozens of graduates to Ivy League colleges every year, and yet the median home value is a mere $1,403,600.

Racial segregation has declined with the rise of economic segregation. We in the 9.9 percent are proud of that. What better proof that we care only about merit? But we don’t really want too much proof. Beyond a certain threshold—5 percent minority or 20 percent, it varies according to the mood of the region—neighbourhoods suddenly go completely black or brown. It is disturbing, but perhaps not surprising, to find that social mobility is lower in regions with high levels of racial segregation. The fascinating revelation in the data, however, is that the damage isn’t limited to the obvious victims. According to Raj Chetty’s research team, “There is evidence that higher racial segregation is associated with lower social mobility for white people.” The relationship doesn’t hold in every zone of the country, to be sure, and is undoubtedly the statistical reflection of a more complex set of social mechanisms. But it points to a truth that America’s 19th-century slaveholders understood very well: Dividing by colour remains an effective way to keep all colours of the 90 percent in their place.

With localized wealth comes localized political power, and not just of the kind that shows up in voting booths. Which brings us back to the depopulation paradox. Given the social and cultural capital that flows through wealthy neighbourhoods, is it any wonder that we can defend our turf in the zoning wars? We have lots of ways to make that sound public-spirited. It’s all about saving the local environment, preserving the historic character of the neighbourhood, and avoiding overcrowding. In reality, it’s about hoarding power and opportunity inside the walls of our own castles. This is what aristocracies do.

Zip code is who we are. It defines our style, announces our values, establishes our status, preserves our wealth, and allows us to pass it along to our children. It’s also slowly strangling our economy and killing our democracy. It is the brick-and-mortar version of the Gatsby Curve. The traditional story of economic growth in America has been one of arriving, building, inviting friends, and building some more. The story we’re writing looks more like one of slamming doors shut behind us and slowly suffocating under a mass of commercial-grade kitchen appliances.